Smart Way To Get The Best Currency Exchange Rates

Make sure you get the best rates when changing money in Spain

I know, when the sun is shining and the beach, golf course or café is calling, the last thing you want to think about is currency!

But this really is an important subject both for people living in Spain and even more so for people thinking of buying a home here. So bear with me while I try to make this worth 45 seconds of your time.

Firstly, if you buy a home when the pound is strong you may be setting yourself up for disaster. We all do it: we see the pound has suddenly shot up in strength and quickly look at the property websites and see how many more thousands of euros we can suddenly afford. But what goes up surely comes down and over the course of the buying process the strength of the pound can drop by 2, 3, 5 or even 10%. It happened after the Brexit referendum, after last yearâs election and could well happen again this summer and autumn. If the pound falls while youâre buying, the property is likely to cost many thousands more by the time you come to pay for it.

The good news is that you donât have to take the exchange rate on the day you complete. As soon as you agree a price, and before you sign anything, you should be talking to a currency specialist about locking in the exchange rate via a forward contract.

Yes, I said a currency specialist. Banks are great for your everyday transactions but they just donât have the personal touch or the expertise in, for example, transferring money for property purchases. This is a complex area of finance, and just as we donât recommend using a divorce lawyer to buy your home, donât use your high street bank for currency.

Your currency company should be regulated by the FCA (the UKâs Financial Conduct Authority), licensed as a money transmitter by the HMRC and a member of AFEP (the Association of Foreign Exchange and Payment Companies). They should keep your money in a separate client account, not hold it themselves.

Sorry, Iâve got boring! Fun financial fact: interest on a loan is believed to derive from the prehistoric days when a loan was most likely to be of livestock. Interest was the calves or lambs born during the period, which the lender got to keep. Thatâs not at all relevant, but we thought find it interesting!

One subject that isnât at all boring, is risk. As well as the âcurrency riskâ, that your pounds will suddenly buy you far fewer euros because some piece of economic or political news has sunk the pound, there is the risk of something going wrong at the crucial time in your property purchase. Working across two countries, languages, legal and financial systems, the last thing you need is for something to go wrong when youâre in the notaryâs office. That is why we recommend using a company where you can actually speak to your currency broker or named account manager on the phone. Some currency companies, like the banks, hide behind âappsâ or make it impossible to get through their telephone system.

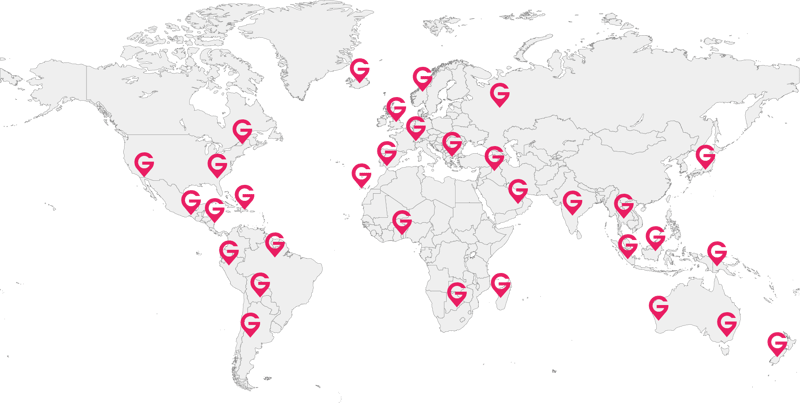

As you probably guessed, we do have a company in mind. Smart Currency Exchange has been one of the most respected names for property buyers and expats in Spain since 2004. They have helped thousands of people to move to Spain, transferring over £5 billion on behalf of clients.

We trust them. The thousand+ contributors to Trustpilot, who have given them a 9.8 out of 10 rating trust them. And you can trust them too.

For those already living in Spain, using Smart makes just as much sense. Speak to them about Regular Payment Plans (RPP) which can both automate paying your regular bills and fix your exchange rate so you can budget effectively.

For those already living in Spain, using Smart makes just as much sense. Speak to them about Regular Payment Plans (RPP) which can both automate paying your regular bills and fix your exchange rate so you can budget effectively.

Speak to them about sending your funds back to the UK if youâre taking advantage of the weak pound and moving back to the UK.

In fact just speak to Smart, whatever your needs! Theyâve offices in London, the Costa del Sol and Costa Blanca.

READ MORE ABOUT SMART CURRENCY EXCHANGE